Islamic mortgages in Dubai are Sharia-compliant home loans that avoid interest (Riba) and instead use profit-sharing or lease-based models like Murabaha, Ijara, and Musharaka. They offer transparency, halal financing, and flexible options for expats and investors.

Why Islamic Mortgages Are Growing in Dubai

Dubai’s real estate market is one of the fastest-growing globally, attracting expats and Muslim investors seeking safe, ethical financing. With a population where over 75% are expatriates and a rising preference for Sharia-compliant investments, Islamic mortgages in Dubai are becoming a key financial tool.

Unlike conventional loans, Islamic home financing avoids interest (Riba), making them halal and aligned with Islamic law. But how do they actually work, and are they right for you? Let’s explore.

What Is an Islamic Mortgage in Dubai?

An Islamic mortgage is a Sharia-compliant home loan where banks and buyers enter into agreements that avoid interest but still allow property financing.

Key principles:

- No Riba (interest): Banks earn profit through trade or lease, not lending interest.

- Risk-sharing: Both the buyer and bank share investment risks.

- Asset-backed: Financing is tied to real property, ensuring transparency.

Unlike conventional mortgages where you borrow money, in a Halal mortgage Dubai banks either buy and sell the property to you (Murabaha) or lease it until you own it (Ijara).

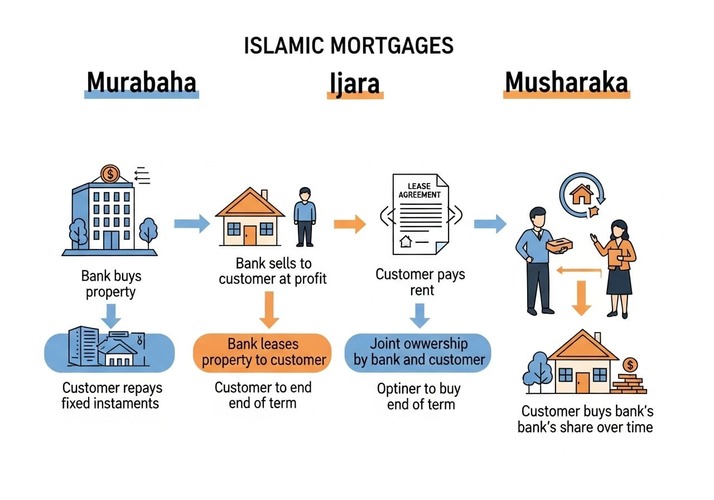

Types of Islamic Mortgages in Dubai

1. Murabaha Mortgage Dubai (Cost-Plus Financing)

- The bank buys the property and sells it to you at a higher price.

- Payments are made in fixed installments over a set period.

- Transparent, with profit agreed upfront.

Best for: Buyers who want predictable payments and transparency.

2. Ijara Mortgage UAE (Lease-to-Own Model)

- The bank purchases the property and leases it to you.

- You pay rent + gradual ownership installments.

- Ownership transfers fully at the end of the lease term.

Best for: Expats who want flexibility and lower initial payments.

3. Diminishing Musharaka (Partnership Model)

- You and the bank co-own the property.

- Over time, you buy out the bank’s share until full ownership is achieved.

- Payments consist of both rent (for bank’s share) and purchase installments.

Best for: Long-term investors and homeowners looking for equity growth.

Benefits of Islamic Mortgages in Dubai

- Sharia-compliant: 100% halal with no Riba.

- Transparency: Clear profit margins agreed upfront.

- Risk-sharing: Bank and buyer share investment responsibility.

- Flexibility: Options for expats, investors, and first-time buyers.

- Investor appeal: Attractive for Muslims seeking ethical investing.

Eligibility & Application Process

To apply for a Sharia-compliant home loan UAE, you’ll generally need:

- Valid UAE residency visa (some banks allow non-residents).

- Emirates ID & passport.

- Salary certificate (usually AED 10K+ income).

- Bank statements (3–6 months).

- Property details (off-plan or ready-to-move).

Major banks offering Islamic mortgages in Dubai include Dubai Islamic Bank, Emirates Islamic, and Abu Dhabi Islamic Bank.

Islamic vs Conventional Mortgages in Dubai

| Feature | Islamic Mortgage | Conventional Mortgage |

| Interest | ❌ No interest (profit-based) | ✔️ Interest (Riba) |

| Ownership | Shared / Lease-to-own | Immediate |

| Transparency | Profit agreed upfront | Interest rate may fluctuate |

| Sharia Compliance | ✔️ 100% Halal | ❌ Not compliant |

Why More Buyers Are Choosing Islamic Mortgages in 2025

Dubai’s property market is evolving, and halal mortgage Dubai products are at the center of this growth. As regulations by the Dubai Islamic Economy Development Centre (DIEDC) and demand from global investors rise, Sharia-compliant mortgages offer a secure, ethical, and profitable financing path.

Whether you’re investing in a Downtown Dubai apartment for sale, a 2-bedroom flat in Dubai Marina, or luxury villas, Islamic mortgages provide a structured, halal alternative to traditional financing.

Should You Choose an Islamic Mortgage in Dubai?

If you’re looking for a Sharia-compliant home loan UAE, Islamic mortgages offer peace of mind, financial transparency, and halal ownership. With multiple structures—Murabaha, Ijara, and Musharaka—you can find an option that suits your budget and lifestyle.

Looking to buy property in Dubai? Contact Splendor.ae today for expert mortgage guidance and exclusive listings.

FAQs

1. What is an Islamic mortgage in Dubai?

An Islamic mortgage in Dubai is a Sharia-compliant home loan that avoids interest (Riba). Instead of charging interest, banks use models like Murabaha (cost-plus sale), Ijara (lease-to-own), or Musharaka (partnership). These ensure the financing is halal, transparent, and based on real asset ownership, making it a popular choice for Muslim investors and expats.

2. How does an Islamic mortgage differ from a conventional mortgage?

The key difference is that a conventional mortgage charges interest (Riba), while an Islamic mortgage uses profit-sharing or lease agreements. With Islamic home loans, ownership is often shared or transferred gradually, and payments are structured as rent or profit installments, not interest. This makes them compliant with Islamic finance principles.

3. What types of Islamic mortgages are available in Dubai?

The main types of Islamic mortgages in Dubai include:

- Murabaha: Bank buys property and sells to buyer at fixed profit.

- Ijara: Lease-to-own where you pay rent plus ownership installments.

- Diminishing Musharaka: Bank and buyer co-own property, and buyer gradually buys out bank’s share.

4. Who can apply for an Islamic mortgage in the UAE?

Most banks in the UAE allow residents, expats, and even some non-residents to apply for an Islamic mortgage. Typical requirements include: Emirates ID, valid residency visa, salary certificate (usually AED 10K+), recent bank statements, and property details. Some banks also cater to overseas investors buying Dubai real estate.

5. Which banks offer Islamic mortgages in Dubai?

Several banks in Dubai provide Sharia-compliant home loans, including:

- Dubai Islamic Bank (DIB)

- Emirates Islamic Bank

- Abu Dhabi Islamic Bank (ADIB)

- Noor Bank

- Mashreq Al Islami

These banks offer Murabaha, Ijara, and Musharaka models tailored for expats and investors.

6. Is an Islamic mortgage in Dubai more expensive than a conventional one?

Not necessarily. While Islamic mortgages may have slightly higher upfront costs, they provide fixed profit margins, ensuring transparency and protection from fluctuating interest rates. Conventional mortgages may seem cheaper initially but can become costlier if interest rates rise. The best choice depends on your financial goals and risk tolerance.

7. What documents are required for a Sharia-compliant home loan in Dubai?

For most Islamic mortgage applications, you’ll need:

- Passport & valid UAE residency visa

- Emirates ID

- Salary certificate or income proof

- 3–6 months of bank statements

- Property details (title deed or sales agreement)

Some banks may request additional proof for self-employed applicants or non-residents.

8. Can expats get an Islamic mortgage in Dubai?

Yes, expats can apply for Islamic mortgages in Dubai. Many banks offer Sharia-compliant home loans to expatriates and overseas investors. Eligibility usually requires a valid residency visa, income above the minimum threshold, and supporting financial documents. Expats benefit from halal financing while investing in Dubai’s booming property market.

9. What are the benefits of a halal mortgage in Dubai?

The main benefits of halal mortgages in Dubai include:

- 100% Sharia compliance (no Riba).

- Transparent and pre-agreed profit margins.

- Risk-sharing between buyer and bank.

- Flexible models (Murabaha, Ijara, Musharaka).

- Accessibility for expats and investors.

These advantages make them a secure and ethical way to finance property.

10. How do I choose between Islamic and conventional mortgages in Dubai?

When choosing between Islamic vs conventional mortgages, consider:

- Faith compliance: If avoiding Riba is essential, Islamic mortgages are the only halal option.

- Cost structure: Islamic loans use fixed profit; conventional uses variable interest.

- Flexibility: Conventional may offer broader product range, but Islamic ensures transparency.

Evaluate based on your budget, values, and long-term goals.