Introduction to Mortgage Calculators

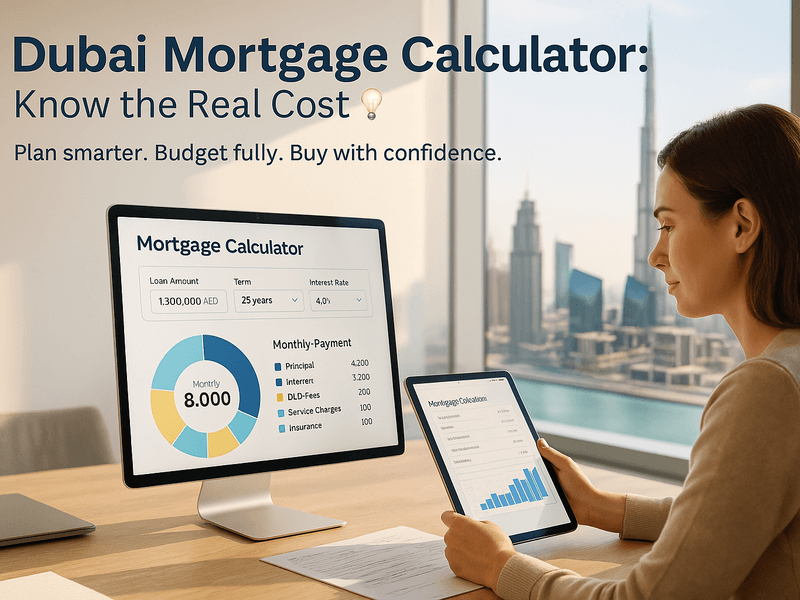

A mortgage calculator is an invaluable tool for anyone looking to purchase property in the UAE. It provides an instant estimate of your monthly mortgage payment, helping you understand the costs involved in taking a mortgage. By inputting key details such as the property value, down payment percentage, mortgage amount, interest rate, and loan duration, you can get a clear picture of your financial commitment.

Using a mortgage calculator allows you to make informed decisions when choosing a mortgage lender and option. The UAE Central Bank regulates the mortgage market, ensuring that lenders offer competitive rates and transparent terms. Whether you’re estimating the monthly payment for a new property or considering refinancing an existing mortgage, a mortgage calculator can provide valuable insights for illustrative purposes.

Banks play a crucial role in determining mortgage terms by evaluating multiple financial factors, such as loan amount, interest rate, loan tenure, income, and existing debts. Understanding specific terms and requirements from different banks is essential when working with mortgage advisors.

Another critical factor that banks assess is the loan-to-value (LTV) ratio, which they use along with other factors to evaluate the borrower’s ability to afford the mortgage.

Various tools are available for mortgage calculations, including a mortgage calculator that helps users estimate their monthly payments based on inputted variables.

The Real Cost of Homeownership in Dubai

Buying a home in Dubai is a dream for many—whether it’s a sleek apartment in Downtown, a villa in Arabian Ranches, or a family-friendly community in Mirdif. But beyond the glossy brochures and stunning show units lies something more important: realistic financial planning.

Too many buyers use a basic mortgage calculator Dubai, looking only at principal and interest. But that’s not enough. If you’re planning to buy property in Dubai, you need to understand the full picture—including fees, insurance, and service charges. This process involves understanding all the costs associated with homeownership.

Let’s break it down.

Understanding Home Loans

A home loan, also known as a mortgage loan, is a financial product used to purchase property. When you take out a home loan, you receive a loan amount that you repay over time through monthly mortgage payments. These payments typically include both principal and interest. The interest rate on a home loan can be either fixed or variable, depending on the mortgage type.

Fixed-rate mortgages offer stability with a consistent interest rate throughout the loan term, while variable-rate mortgages feature fluctuating interest rates based on market conditions. The loan term, or repayment period, can range from 10 to 25 years, depending on the lender and your affordability. The UAE offers various mortgage options, including fixed-rate and variable-rate mortgages, to suit different needs and budgets.

Why the Right Mortgage Calculator Matters

A standard home loan calculator Dubai gives you an estimate of your monthly payment based on:

- Loan amount

- Interest rate

- Loan term

But it often misses key monthly costs like:

- Property-related fees (DLD, Municipality Housing Fee, Registration)

- Service charges (maintenance)

- Home & life insurance

To get the full picture, you need a mortgage loan calculator Dubai that accounts for all of these. Various tools, including a comprehensive mortgage calculator, can help you get an accurate estimate of your monthly payments. Otherwise, you risk underestimating your monthly commitment—and that can be costly.

What’s Included in a Complete Mortgage Payment in Dubai?

1. Principal & Interest

The principal is the amount you borrow. The interest, determined by the mortgage rate, is what the bank charges you to borrow it.

Tip: Choose between:

- Fixed-rate mortgage – Stable monthly payments

- Variable-rate mortgage – Lower initial rate, but subject to change

Rates in Dubai start around 2.49% to 5% per annum, depending on your credit score, income, and mortgage broker Dubai.

2. Property Fees: Dubai’s Hidden “Tax”

While there’s no annual property tax in Dubai, there are still significant government-related costs:

| Fee | Amount |

|---|---|

| DLD Fee | 4% of property value (one-time) |

| Registration Fee | AED 2,000–4,000 + VAT |

| Municipality Housing Fee | 5% of property’s annual rental value (monthly via DEWA) |

| Service Charges | AED 3–30/sq.ft annually |

These fees can impact your overall mortgage repayments, so it’s crucial to understand all associated costs.

Use the Dubai Land Department’s Service Charge Index to estimate service fees.

3. Insurance: Don’t Skip This Step

Lenders usually require:

- Building insurance

- Life insurance (aka mortgage protection)

Optional but wise:

- Contents insurance for your belongings

Costs range from AED 250/year to 0.5% of rebuild value, and can vary depending on your property type and insurer.

Understanding Loan Period

The loan period, also known as the loan term, is the length of time over which the loan is repaid. This period can range from 10 to 25 years, depending on the lender and your financial situation. A longer loan period may result in lower monthly payments, but it can also increase the total amount paid over the life of the loan. Conversely, a shorter loan period may lead to higher monthly payments but reduce the overall cost of the loan.

Choosing the right loan period is crucial, as it significantly impacts your monthly payments and the total amount you will repay. The UAE Central Bank regulates the loan period, ensuring that lenders offer transparent and competitive terms to borrowers.

Factors Affecting Mortgage

Several factors can influence your mortgage, including the property value, down payment percentage, mortgage amount, interest rate, and loan duration. The property value is the total cost of the property being purchased, while the down payment is the percentage of the property value paid upfront. The mortgage amount is the remaining sum borrowed after the down payment.

The interest rate, which can be fixed or variable, represents the cost of borrowing. The loan duration is the length of time over which the loan is repaid. Other factors, such as existing debts, income, and credit score, can also impact your mortgage. The UAE mortgage market is subject to market conditions, and lenders may adjust their interest rates and terms accordingly.

Escrow Accounts: Simplify Your Monthly Costs

Some mortgage lenders in Dubai set up escrow accounts where:

- You deposit part of your monthly payment

- Lenders use it to pay insurance & property fees on your behalf

This helps avoid large lump-sum payments and ensures nothing is missed.

Finding the Best Deal on Home Loans

To find the best deal on home loans, it’s essential to research and compare different mortgage options from various lenders. The UAE offers a range of mortgage products, including fixed-rate and variable-rate mortgages, to suit different needs and budgets. When comparing mortgage options, consider factors such as the interest rate, loan term, and associated fees.

A mortgage calculator can be a useful tool in estimating your monthly payment and understanding the costs involved in taking a mortgage. Additionally, seeking advice from a financial advisor or a mortgage broker can help you find the best deal. The UAE Central Bank regulates the mortgage market, ensuring that lenders offer transparent and competitive terms. By doing thorough research and comparing different options, you can find the best deal on home loans and make an informed decision when purchasing property in the UAE.

How to Use a Mortgage Loan Calculator Dubai the Smart Way

- Choose a calculator from a reputable bank or broker site

- Input:

- Property price

- Down payment

- Loan term (up to 25 years)

- Interest rate

- Add estimated monthly fees:

- Municipality Housing Fee

- Service charges

- Insurance premiums

- Review the full monthly cost, not just principal + interest

- Separate one-time costs (DLD, registration) and plan them into your savings

Banks calculate mortgages by evaluating multiple financial factors, such as loan amount, interest rate, loan tenure, income, and existing debts. Understanding specific terms and requirements from different banks is crucial when working with mortgage advisors.

Work with a mortgage broker Dubai to help compare rates and plan smarter.

FAQs: What Dubai Buyers Want to Know

Q: Is there property tax in Dubai?

No direct annual tax—but DLD fees, registration fees, and service charges apply.

Q: How can I calculate my real monthly mortgage payment?

Use a home loan calculator Dubai that lets you factor in fees and insurance.

Q: Is home insurance mandatory in Dubai?

Only if you have a mortgage—but it’s highly recommended even without one.

Q: What is the minimum down payment to buy property in Dubai?

- Expatriates: 20% for properties < AED 5M

- UAE Nationals: 15%

Q: Why is the loan-to-value (LTV) ratio important in mortgage calculations?

The loan-to-value (LTV) ratio is a critical factor that banks assess when calculating mortgages. Banks take into account the LTV along with other factors such as loan amount, interest rate, and loan tenure to evaluate the borrower’s ability to afford the mortgage.

Q: Where can I find a trusted mortgage broker in Dubai?

Start with licensed brokers, check reviews, and ask for a free consultation.

Real Example: Monthly Budget Breakdown for AED 1.5M Property

| Component | Amount (AED) |

| Mortgage Payment (P&I) | 5,700 |

| Municipality Fee | 625 |

| Service Charges | 375 |

| Home Insurance | 150 |

| Total | 6,850 AED/month |

See the difference? That’s 1,150 AED/month beyond your mortgage payment.

Budget Smarter, Buy with Confidence

Owning property in Dubai is a milestone—but it’s also a financial commitment.

Using a mortgage calculator Dubai the right way means factoring in every hidden cost, not just the loan repayment. With the help of a mortgage loan calculator Dubai, plus a good mortgage broker Dubai, you’ll be able to buy property in Dubai without surprises—and with confidence.Ready to take the next step? Contact Splendor.ae to start your home buying journey with expert financial insight.