Why Renters Feel Surprised

Renting in Dubai often feels like a whirlwind: from glamorous listings to surprise charges you only spot after you’ve moved in. While many see the headline rent, few anticipate the additional costs tucked into contracts—from Ejari to agency commissions. These additional costs can include agency fees, maintenance, utility connection fees, and security deposits, which are often hidden and can catch renters off guard. This guide helps you budget beyond rent, highlighting the importance of planning for expenses upfront to avoid surprises and move in with confidence.

The Hidden Cost of Furnished Properties

Opting for a furnished property in Dubai might seem like a hassle-free solution, but it often comes with several hidden costs that can catch tenants off guard. The security deposit for furnished properties is usually set at 10% of the annual rent—double the amount required for most unfurnished properties. This higher upfront cost can significantly impact your rental budget.

But the extra expenses don’t stop there. Many tenancy contracts for furnished properties in Dubai make tenants responsible for maintaining, repairing, or even replacing furniture and appliances during the lease. If a sofa gets stained or an appliance breaks down, you could be liable for the cost, leading to unexpected expenses at the end of your tenancy. Always review your tenancy contract carefully to understand your obligations regarding the upkeep of furniture and appliances in your rental property.

When budgeting for a furnished property in Dubai, factor in these potential extra costs alongside your annual rent and security deposit. By being aware of these hidden costs, you can avoid unpleasant surprises and budget effectively for your next move—whether you’re considering a furnished or unfurnished property.

Hidden Cost #1 – Ejari & Tenancy Registration

- What it is: Ejari is the government-backed rental registration—mandatory for legal tenancy. The ejari registration fee is a mandatory and essential cost for all tenants, required to legalize tenancy agreements in Dubai. The Dubai Land Department is the authority responsible for overseeing Ejari registration and ensuring compliance for both tenants and landlords.

- How much: Typically AED 170–220, plus admin charges by typing centres or agents.

- Pro tip: Clarify who pays the fee in writing. Ask upfront: “Is Ejari included?” and keep the final Ejari certificate

Hidden Cost #2 – Security Deposit & Conditions

- Typical charge: 5–10% of annual rent, but often equivalent to one month’s rent or a percentage thereof. The security deposit is usually held for “damages beyond wear and tear.”

- What to watch: Terms around cleaning or AC repair can eat into your refund. The deposit amount, typically one month’s rent, is also a key component in calculating upfront rental expenses and early exit penalties.

- Pro tip: Inspect the property in detail—snap photos, get dated receipts, and confirm cleaning expectations with the landlord. The security deposit is refunded when tenants vacate the property, provided there are no damages or outstanding payments.

Hidden Cost #3 – AC Maintenance & Chiller Fees

- Why it’s hidden: Not all contracts include AC servicing or cooling charges, and some may add an agency fee as a standard part of the rental process in Dubai.

- Chiller-included? Some buildings add “chiller-free” fees to service bills. Rental services provided by agencies may include paperwork, Ejari registration, and other support.

- Pro tip: Ask, “How often is AC cleaned?” and “Are chiller cooling costs included?” before signing. Always clarify all additional fees that may be charged by the agency beyond the commission.

Hidden Cost #4 – Agency Commission & Admin Fees

- Standard rate: Agents typically charge 5% of annual rent.

- Possible extras: Admin fees for paperwork or Ejari on top of commission.

- DEWA and utilities: The Dubai Electricity and Water Authority (DEWA) is the water authority and the sole provider of Dubai electricity and water services. A connection fee is required to set up utilities, and connection fees vary depending on the provider and property size. The housing fee (Dubai Municipality fee) is calculated as 5% of the annual rent paid and is paid monthly through the DEWA bill.

- Pro tip: Negotiate an all-inclusive, transparent commission. Or request a “no-fee” offer via your trusted real estate agency in Dubai to budget smarter before buying property.

- Additional costs: Don’t forget to budget for moving costs, including hiring movers and other expenses when relocating to a new property.

Hidden Cost #5 – DEWA Connection & Moving-in Fees

- What to expect: DEWA usually requires AED 2,000–4,000 deposit, plus reconnection fees.

- Maintenance fees and maintenance charges may also be passed on to tenants, depending on the contract, and can add up to significant additional expenses.

- There is often a distinction between the landlord’s responsibility for major repairs and the tenant’s responsibility for minor repairs, such as plumbing or electrical fixes.

- Some communities impose a buildings charge for access to amenities like gyms and pools, which is another cost to consider.

- It’s required before you move in—unexpected if not budgeted.

- Pro tip: Ask the landlord if you can use an existing DEWA account. Or split reconnection deposit.

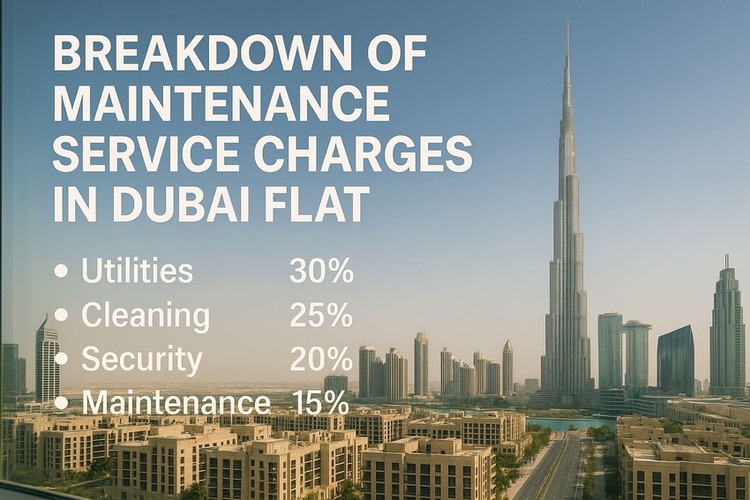

Hidden Cost #6 – Maintenance & Service Charges

- Why it’s hidden: These community fees can be tenant-responsible, depending on your contract. When moving into a new property, you may also face setup fees, deposits, and other costs related to utility connections.

- Typical charges: AED 3–30 per sq ft annually.

- Pro tip: Use Dubai Land Department’s Service Charge Index to check historical rates. Confirm if they’re included in your lease. Breaking a lease or moving out can also result in other hidden costs beyond standard penalties, so always review your contract for any additional cost.

Hidden Cost #7 – Miscellaneous & Early Exit Penalties

- What to expect: Early lease termination fees, paperwork charges, NOC costs.

- Why it hurts: Breaking a lease early can cost 1–2 months’ rent unexpectedly.

- Pro tip: Ask: “What if I leave six months in?” Check for written notice terms in your contract.

The Rent Increase Trap

One of the most overlooked hidden costs of renting in Dubai is the potential for rent increases when renewing your tenancy contract. Dubai’s real estate market is dynamic, and annual rental prices can fluctuate based on demand, location, and market trends. Tenants may find themselves facing a higher annual rental amount at renewal, leading to unexpected expenses that can strain your finances.

To help estimate possible rent hikes, use the RERA Dubai calculator, which provides guidance based on current market rates. However, it’s crucial to read your tenancy contract closely for clauses related to rent escalation and to understand how and when your landlord can increase the rent. Additionally, keep in mind the Dubai Municipality fee—calculated as a percentage of your annual rental—which may also rise if your rent goes up, adding another layer of hidden cost.

To avoid being caught in the rent increase trap, negotiate clear terms in your contract, stay informed about market trends, and always factor in the possibility of higher rent and associated fees when planning your rental budget.

When Things Go Wrong: Disputes and Resolutions

Disputes between tenants and landlords are not uncommon when renting a property in Dubai, and resolving them can sometimes lead to additional costs if you’re not prepared. The Dubai Land Department’s legal contract registration platform, Ejari, plays a crucial role in protecting your rights and providing a clear record of your tenancy agreement.

If disagreements arise—whether over agency fees, security deposits, or utility bills—keep detailed records of all payments and correspondence. This documentation can be invaluable if you need to present your case to the Rental Dispute Center, Dubai’s official platform for resolving rental conflicts. Seeking advice from a reputable property management company or experienced real estate agent can also help you navigate the process and avoid unnecessary additional costs.

By understanding the dispute resolution process and keeping your paperwork in order, you can protect yourself from prolonged disputes and the extra expenses that often come with them.

Know Your Rights: The Renter’s Shield

Navigating Dubai’s rental market is much easier when you know your rights as a tenant. RERA Dubai regulations set out clear guidelines for rental contracts, covering everything from agency fees and security deposits to maintenance costs and housing fees. As a tenant, you’re responsible for paying your monthly rent, housing fees, and sometimes chiller fees, but you’re also entitled to a refundable deposit and uninterrupted access to essential services like water and electricity connections.

Understanding your rights means you can confidently question any additional or hidden costs, and ensure your tenancy contract is fair and transparent. Working with a trusted real estate agent can help you interpret the fine print and avoid being saddled with unnecessary charges. By staying informed and proactive, you’ll enjoy a smoother, more secure rental experience in Dubai.

Dubai Rental Market Trends: Why Hidden Costs Are on the Rise

Dubai’s rental market is evolving rapidly, and with it, the number and variety of hidden costs are increasing. The growing demand for luxurious apartments and villas has led to the introduction of new fees, such as district cooling deposits and connection fees, which can significantly add to your upfront costs. Additionally, new services and innovation fees are being introduced by property management companies, further increasing the overall cost of renting a property in Dubai.

Rising rental prices, coupled with higher agency fees and housing fees, mean tenants need to be more vigilant than ever about budgeting for extra costs. The popularity of additional services and amenities in modern developments also brings with it more opportunities for landlords to pass on extra fees to tenants.

To avoid unpleasant surprises, stay up to date with Dubai rental market trends, compare properties across different neighborhoods, and always ask for a full breakdown of all associated costs before signing a rental contract. By being proactive, you can find a property in Dubai that fits your needs and budget—without falling victim to hidden costs.

Smart Checklist – How to Dodge These Fees

Use this when signing: Confirm Ejari, AC, and chiller fees, and check costs for such services as district cooling or chiller fees Document property condition with dated photos Clarify DEWA setup and deposit responsibility, especially for a one bedroom apartment Ask who pays service charges Get agent fees in writing Discuss exit penalty terms Clarify what is included in a furnished apartment and confirm any related fees If the property is unfurnished, budget for basic furniture Negotiate wisely

Budget Smart = Rent Confident

Smart renters plan beyond rent. Knowing these fees lets you avoid nasty surprises and save thousands. Want help evaluating your lease or cutting costs? Contact Splendor.ae for expert guidance and trusted rentals.

FAQ’s

1. What are the hidden costs when renting an apartment in Dubai?

Hidden costs may include Ejari registration, security deposits, DEWA setup, chiller fees, AC maintenance, service charges, and agency commissions.

2. Is Ejari registration mandatory for renting in Dubai?

Yes, Ejari is legally required for every rental agreement in Dubai and is overseen by Dubai’s Land Department. It validates your lease and is needed for utilities, visa renewals, and disputes.

3. Who pays for DEWA in a Dubai rental property?

Tenants are typically responsible for DEWA setup, including a deposit (AED 2,000–4,000) and activation fees unless otherwise agreed in the contract.

4. What is a chiller fee in Dubai and is it included in rent?

A chiller fee covers centralized cooling. Some buildings include it in rent (“chiller-free”), while others bill tenants separately.

5. How much is the security deposit for renting in Dubai?

Usually 5% of the annual rent for unfurnished apartments and 10% for furnished ones, refundable at the end of tenancy.

6. Are maintenance and service charges paid by the tenant or landlord?

It depends on the contract. Tenants often pay minor maintenance and service charges, especially in freehold communities.

7. How much is the agent commission when renting in Dubai?

Most real estate agents charge 5% of the annual rent or a flat fee—ensure it’s agreed upon in writing before signing. Rental services provided by agencies may include support with paperwork, negotiations, and ensuring legal compliance.

8. What should I check before signing a tenancy contract in Dubai?

Clarify all fees (Ejari, DEWA, chiller, maintenance), review exit clauses, confirm AC servicing, and request a detailed property handover checklist.

9. Can I negotiate rental costs or fees in Dubai?

Yes, you can negotiate rent, agent commission, and even fee-sharing for DEWA or maintenance, especially in tenant-friendly markets.

10. What’s the difference between “chiller-free” and “chiller-included” apartments?

“Chiller-free” means the landlord covers the cooling charges, whereas “chiller-included” could still mean hidden fees—always ask for clarification.